A rising tide lifts all boats, but one boat is riding a slightly higher wave and that is Nvidia’s Spectrum-X Ethernet switch and DPU combo, which has become a preferred network for back-end networks for interconnecting AI clusters that scale beyond the rackscale domain of the higher-performance NVSwitch memory fabric also sold by Nvidia.

The magnitude of the Nvidia Ethernet leap is dramatic, just as has been the jump in compute for Nvidia over the past two years.

Cisco Systems is still the dominant supplier of Ethernet switches across the datacenter, the edge, and the campus, but perhaps not for long given the expected demand of AI clusters in the coming years. Nvidia’s Ethernet business is now larger than that of Arista Networks, which has been dogging Cisco in the datacenter for the past decade and a half and which aimed to break $10 billion in sales next year, two years earlier than its top brass had planned. And even with the just completed Juniper acquisition, the embiggened HPE Networking will have trouble catching Nvidia in the datacenter even moreso than both Cisco and Arista.

Let’s go over the numbers from IDC about the Ethernet switching market for the second quarter of 2025, which as usual we have enhanced with our own estimations, and then drill down into the datacenter that we focus on here at The Next Platform. (Our estimates are shown in bold red italics in the tables below, as always.)

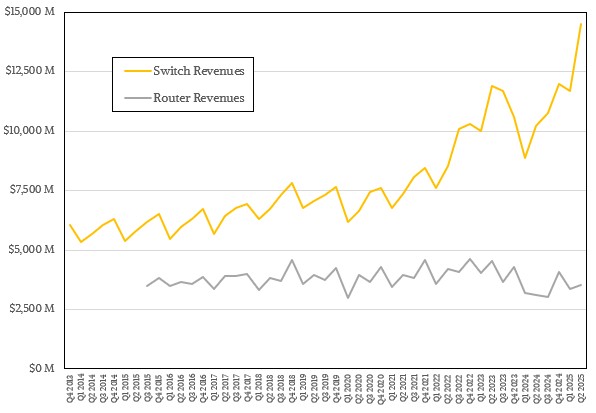

In the June quarter, IDC reckons that companies around the world bought $14.51 billion of Ethernet switching year, an increase of 42.1 percent from the year ago period and a whopping 23.9 percent sequentially from Q1 2025.

Switching is exploding, and there is a chance that routing may, too, as datacenters are interconnected to make larger AI cluster footprints.

IDC said in statements accompanying its numbers that Cisco had 32.9 percent of router sales, which works out to $1.16 billion, and increase of 17.7 percent year on year. This means Cisco is growing faster than the router market at large. With only 13.3 percent growth, Huawei, at $1.08 billion in router sales, is growing slower than the market. We do not know Juniper’s slice of routing, but in the wake of the HPE acquisition it will no doubt be mentioned in the next report, which will be for the first full quarter that Juniper has been part of HPE.

The New Switcheroo

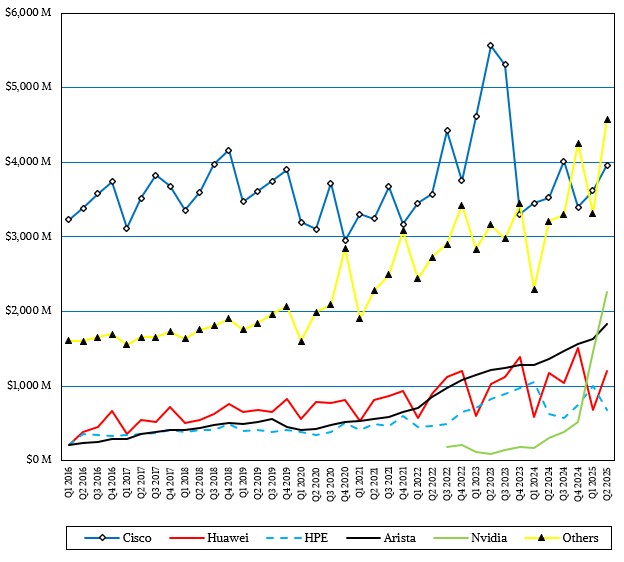

Here is the historical trend of Ethernet switch revenues by vendor that IDC puts together each quarter, with the Q2 numbers tacked on:

Q1 looked to be a little bit soft, as we can now see, but was nothing out of the ordinary. The first quarter of any year tends to be weaker than the fourth quarter of any prior year. It is just during boom times that this doesn’t always happen.

A stacked bar chart is, by definition, hard to convey trendline information at a granular level, which is why companies use them. It gives you a feel for the data, but not as good as a longer set of actual trendlines that overlap by category. So here is what we think is a better visual, with a longer runway of data, to help you see the trends:

Cisco is still the biggest peddler of Ethernet switch gear, at $3.96 billion, but it is growing about a quarter as fast as the market overall because it is not really getting much action in AI networking. At least not compared to upstart Nvidia. Moreover, Arista is giving Cisco some grief in the campus switching market where it has had hegemony for decades – although not as much grief as Ullal & Co had been hoping, we think. (These things take time.)

Nvidia, which is only sells datacenter Ethernet switching gear, is now not just a little bit ahead of Arista, but a lot bit. In the June quarter, we reckon that based on IDC statements that Nvidia had $2.26 billion in Spectrum switch sales, up by a factor of 7.5X compared to the year ago quarter.

Arista, interestingly did not grow as fast as the average that was significantly lifted by the massive AI buildout that Nvidia has engineered – and engineered over the past decade brilliantly, we might add – had Ethernet switch sales of $1.83 billion, up “only” 33.5 percent year on year and up “only” 12.4 percent sequentially.

Huawei had $1.2 billion in Ethernet switch sales, up 2 percent from the year ago period but up 77.6 percent sequentially from a pretty bad Q1. Other vendors, including the original design manufacturers who make custom gear for hyperscalers, cloud builders, telcos, and large service providers, accounted for $4.58 billion, up 42.5 percent and keeping pace with the overall market.