As global connectivity expands, consumer demand for high-speed, reliable internet is escalating exponentially. Fiber-to-the-home (FTTH) network providers and digital infrastructure investors have responded to consumer demand with rapid deployment growth.

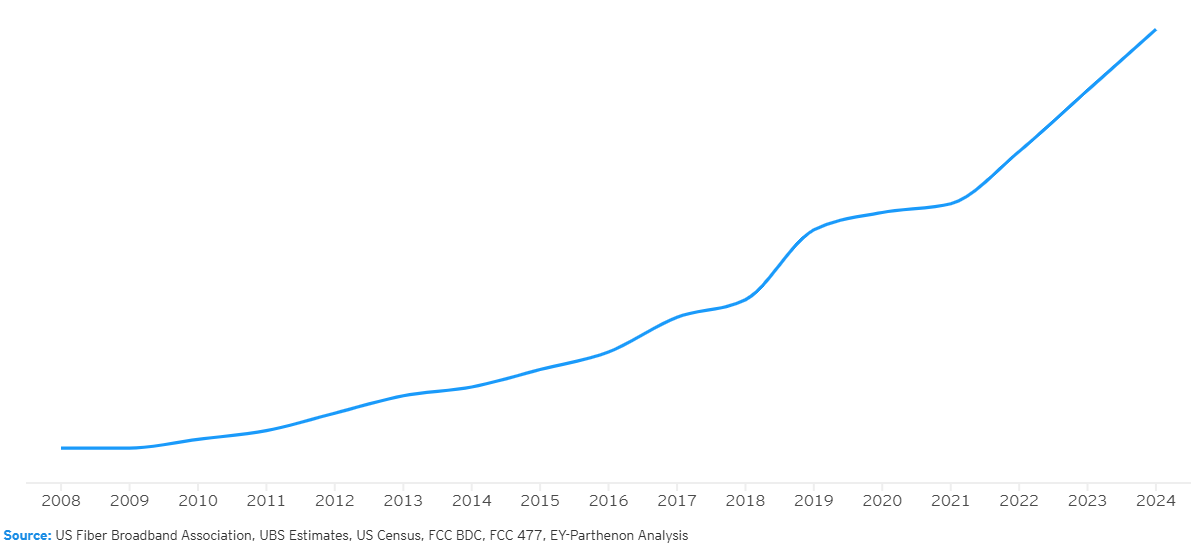

As of the end of 2024, nearly 80 million US homes had access to fiber – more than half of residences in the country – up from approximately 60 million in 2022.1 The drive for fiber has been accelerated, in part, by government subsidies, such as the $42b of Broadband Equity, Access and Deployment (BEAD) funding set aside to improve the US’s broadband internet infrastructure.

Total US fiber-to-the-home passings, % of total US homes

However, with FTTH competition intensifying, infrastructure costs climbing and consumers demanding both speed and affordability, fiber providers need to be creative in how they capture their share of the FTTH prize.

Consumer demand and better performance drive a strong adoption case for FTTH

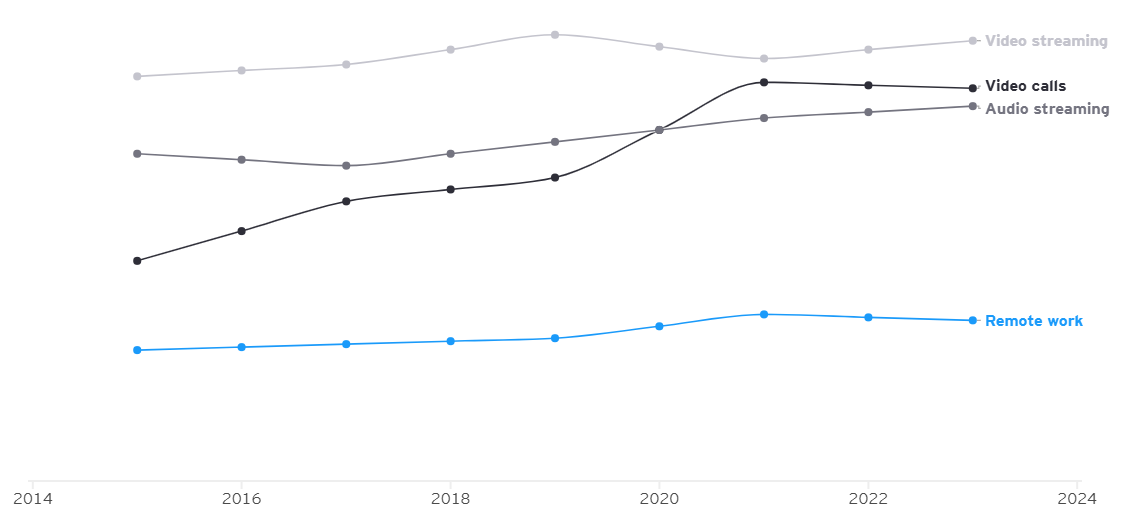

Over the last five years, US customer consumption of broadband has grown 20% year-over-year (YOY), driven by the proliferation of video and audio content streaming, 4K content demand and remote work, especially during the COVID-19 pandemic.

Remote work bolstering bandwidth demand growth

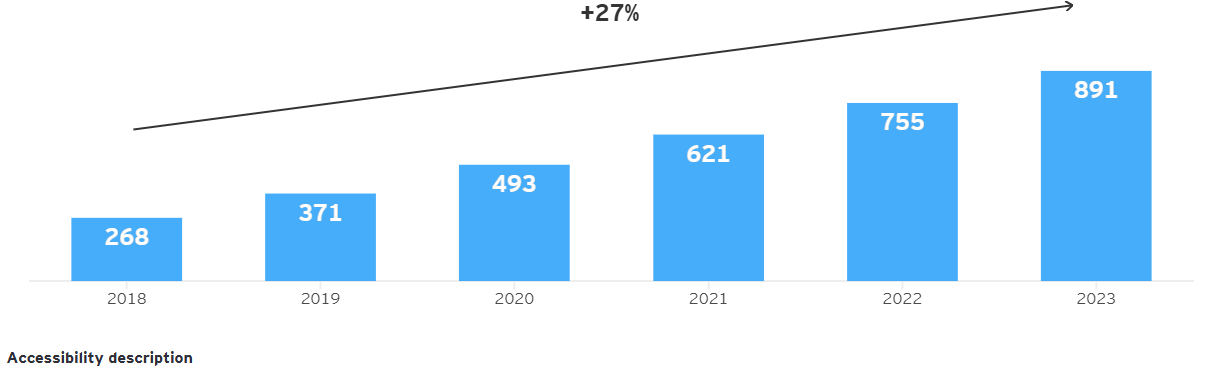

4K device proliferation

With more of their home lives reliant on digital technologies, consumers want assurances around the performance of their internet service. According to the EY Global Digital Home Study Report 2024, nearly half (46%) of US respondents cite guaranteed broadband speed as the number one driver of internet purchasing decisions. The quality of FTTH may resonate with consumers because network reliability remains a point of frustration, with 26% of US respondents saying they experience unreliable home internet, even with ongoing network upgrades by providers.

FTTH offers a robust solution that covers performance and reliability demands with symmetrical bandwidth and low latency.

While consumer FTTH demand continues to strengthen, FTTH expansion opportunities have shrunk

Although consumer demand for FTTH networks remains strong, the universe of economically viable opportunities for new FTTH infrastructure has contracted considerably in recent years. Key drivers include:

The acceleration of competitive FTTH buildouts.

Labor cost increases, which are increasing build costs and negatively impacting returns.

The impact of higher interest rates on required FTTH return hurdles.

With urban and dense suburban areas becoming increasingly competitive, fiber builds have gradually shifted to less dense regions, such as the outer suburbs or “dense rural” towns.

An estimated 46% of new FTTH builds in 2024 were in lower density suburban and rural areas where there are fewer than 60 homes per road mile, up from 35% in 2023.

\

\

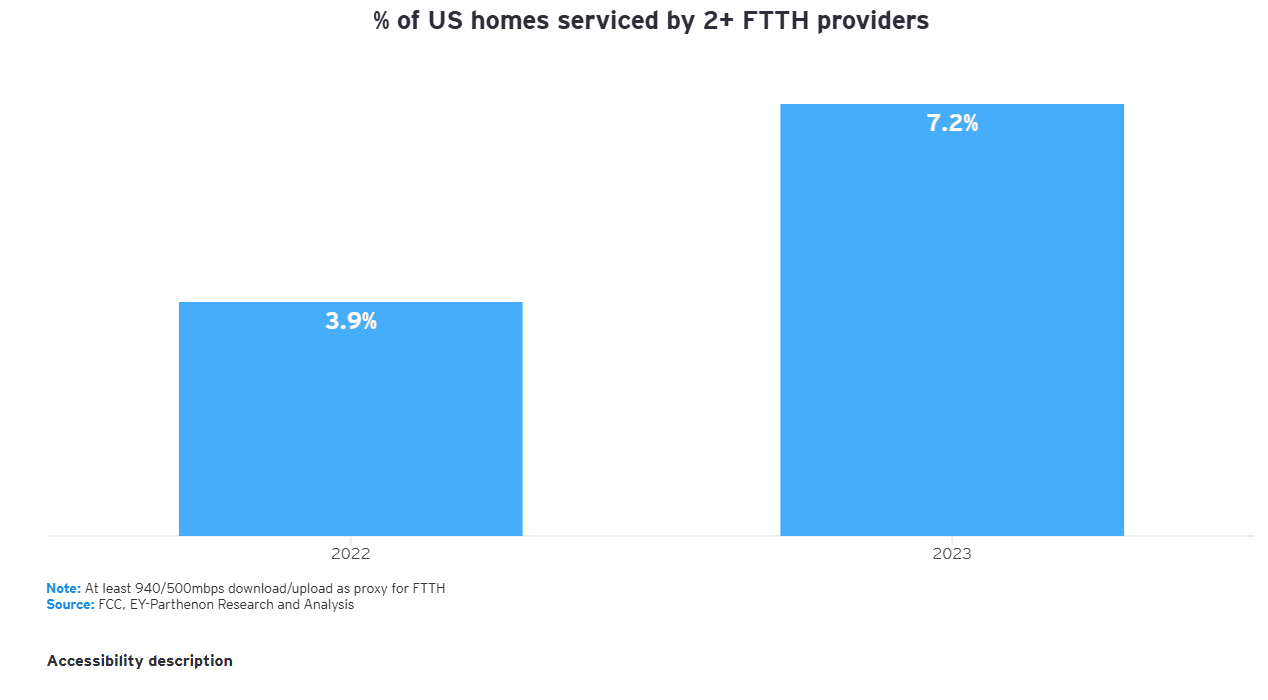

The shrinking development landscape means the risk of overbuilding has increased significantly in many of the denser areas. According to the Federal Communications Commission’s (FCC) US Communications Marketplace Report, in 2022, roughly 4% of US homes had access to two or more FTTH options: typically, incumbent local exchange carrier (ILEC) fiber. In 2023, the number rose to approximately 7% of US homes, a near doubling in FTTH versus FTTH provider competition.