In the wave of rapid development of digitalization and artificial intelligence, the importance of data centers has become increasingly prominent, and their demand for optical fiber cables has also become the focus of industry attention. CRU's recently released forecast of demand for optical fiber cables in data centers is now online. The main information obtained from publicly released reports is as follows:

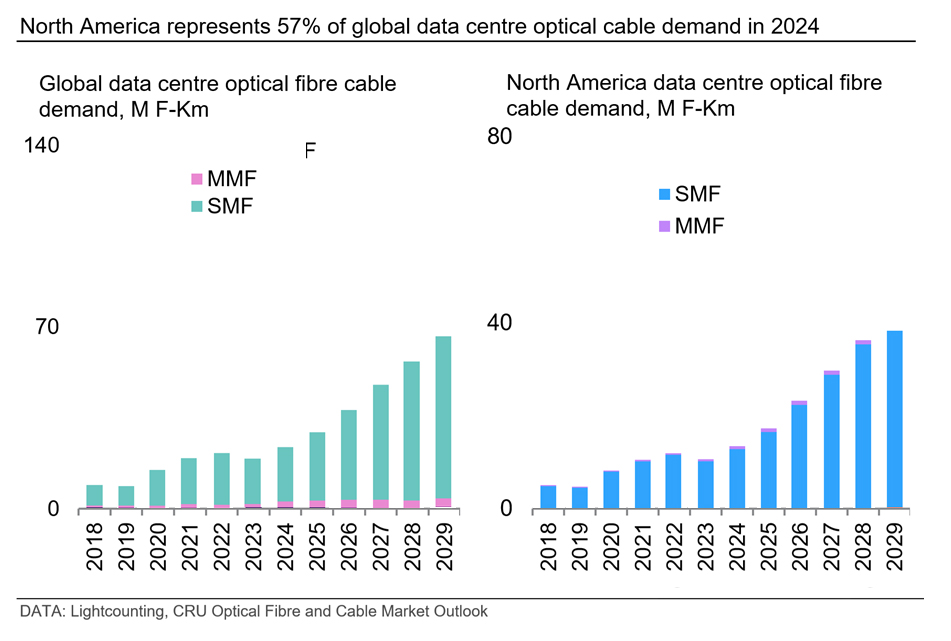

From the perspective of market growth forecasts, the global data center market is showing a rapid development trend, with North America, Europe and China becoming the main engines of growth. It is estimated that by 2025, the demand for optical cables in data center applications will account for about 5% of the total global demand for optical cables, and more than 14% in North America; by the end of this century, the global share will exceed 11%. Among them, the consumption growth of single-mode and multi-mode optical fiber cables in cloud and AI data centers is very significant, indicating a broad prospect in the field of optical communications in data centers.

Behind the growth in demand, generative AI and increased investment in data center construction are two key factors. From 2019 to 2024, U.S. data center construction spending increased by about 210%. The influx of a large amount of funds has prompted the construction of data centers like mushrooms after rain. At the same time, the rapid development of AI has put forward higher requirements for high-speed and low-latency data transmission. As a key carrier of data transmission, the demand for optical fiber and optical cable has ushered in explosive growth. Whether it is the connection between servers within the data center or the communication between data centers, it is inseparable from it.

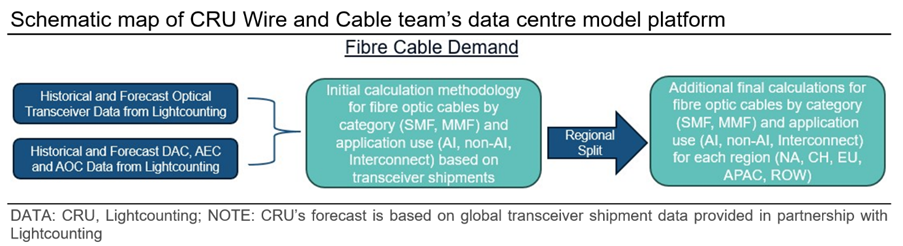

In order to accurately predict demand, CRU cooperated with LightCounting and adopted a more accurate prediction method. Based on the shipment data of optical transceivers, they fully considered factors such as transmission distance and number of optical fibers, accurately calculated the demand for different types of optical cable core kilometers, and grouped them by AI, non-AI and data center interconnection applications, providing a valuable reference for the industry.

In terms of technology trends, single-mode fiber has become the main choice for connections inside and outside the data center due to its excellent performance. In conjunction with DWDM technology, it has greatly increased bandwidth. Data centers are also constantly migrating to 400G, 800G and 1.6T solutions to meet the growing demand for data transmission. As a newer generation of multimode fiber, OM5 fiber supports multiple wavelengths on a single fiber, allowing higher data rates and extending the feasibility of multimode fiber in future short-distance, high-speed connections. These technological advances are paving the way for more efficient, scalable and cost-effective fiber optic cable solutions in data centers, enabling them to meet the growing needs of the digital economy. Other technological advances, such as advances in silicon photonics, are also continuing to drive the upgrade of optical cable solutions.

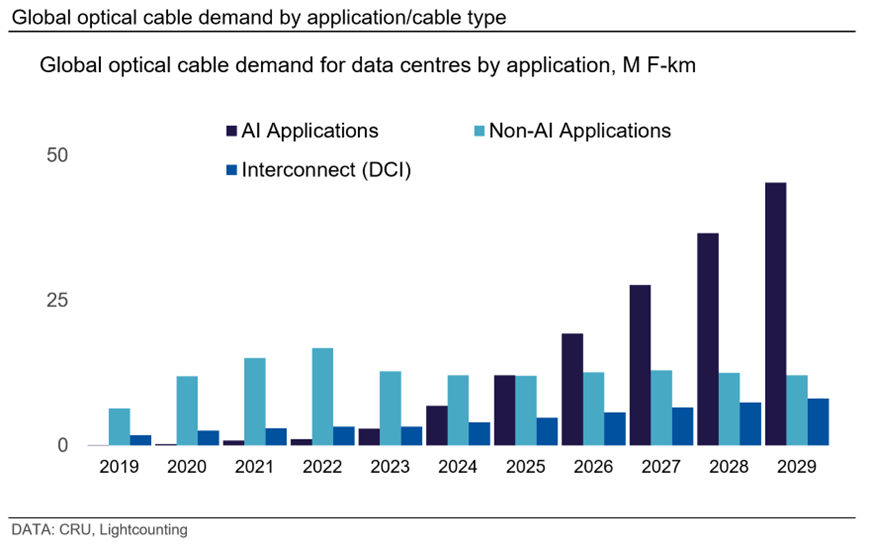

Analyzing the demand categories, we can more intuitively see the impact of AI. The demand for optical cables for AI applications will increase by 138% year-on-year in 2024, and is expected to grow by 77% in 2025. The five-year compound annual growth rate will be 26% in 2029, far exceeding non-AI applications. AI has become the locomotive driving the growth in demand for optical fiber cables in data centers.

The industry is expected to continue to expand as data centers evolve to meet the demands of the escalating digital economy. The combination of DWDM technology and next-generation fiber will play a key role in supporting the exponential growth in data traffic while enabling more cost-effective and energy-efficient connectivity solutions.